Colleen Hearn Broker, CLHMS®, e-broker®, e-agent®, REALTOR®

Residential and Commercial Real Estate Broker

Phone: 514.694.2121

Cell: 514.830.0827

Email

263-C

SAINT-JEAN

BLVD

Pointe Claire,

QC

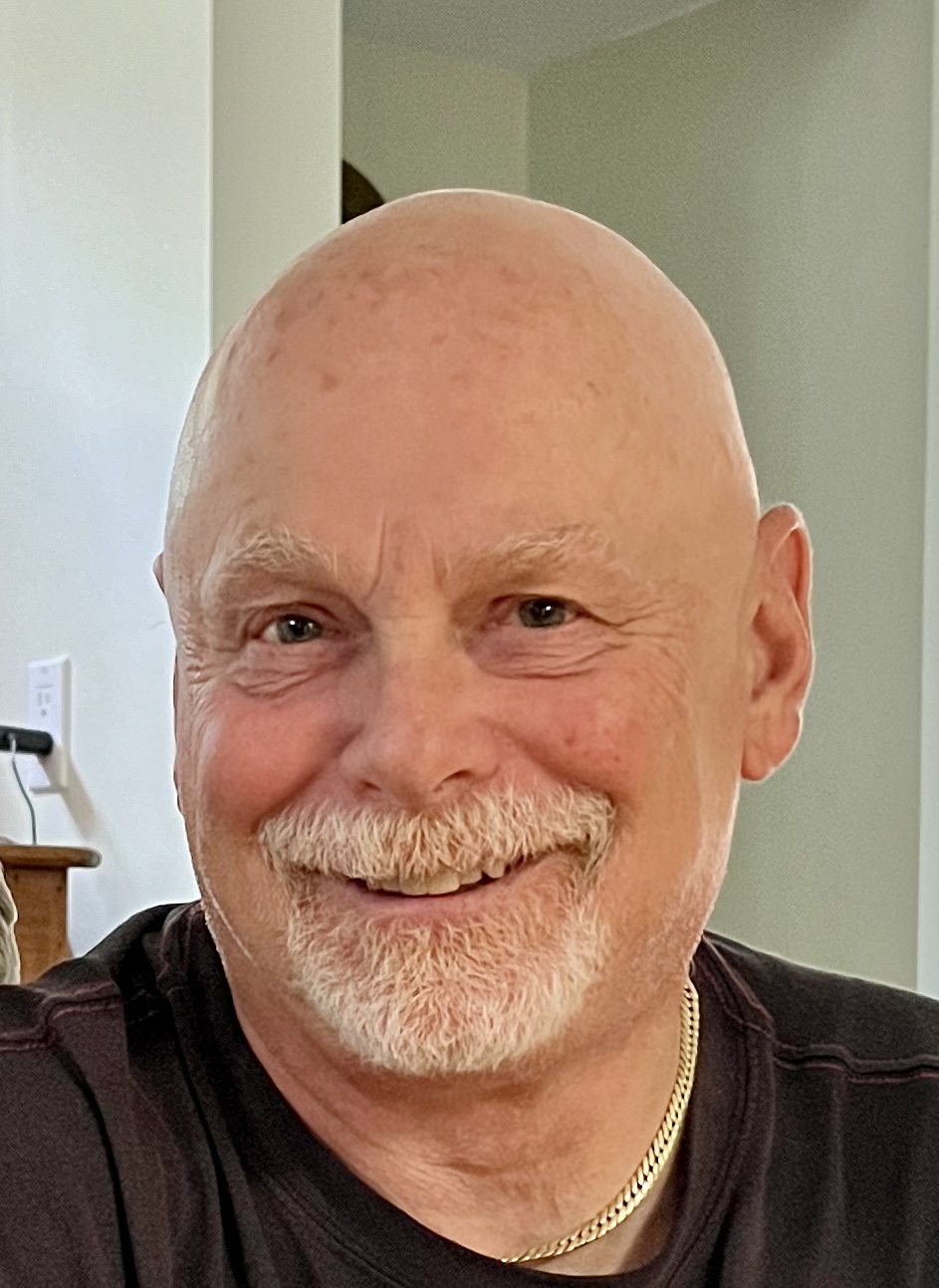

Keith Gold

Residential and Commercial Real Estate Broker

Phone: 514.694.2121

Cell: 514.830.2638

Email

263-C

SAINT-JEAN

BLVD

Pointe Claire,

QC

Colleen and Keith are a dynamic team.

Offering full real estate services for more than 20 years, they continue to help buyers or sellers all over Montreal with a strong focus on the West Island and waterfront communities.